AMENITIES

INDOOR OUTDOOR

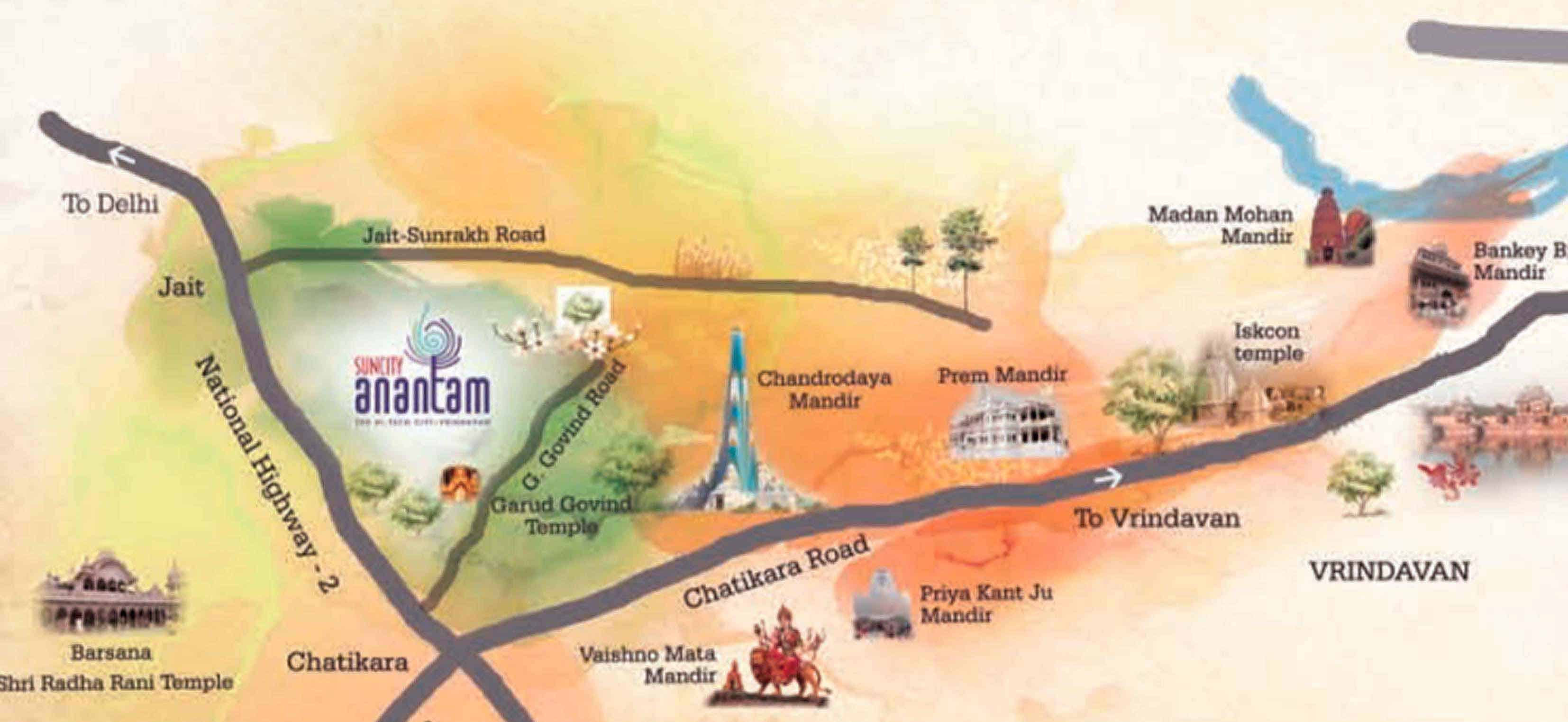

Premium Connectivity

Frequently Asked Questions-

Bankey Bihari Mandir – 3-4 km

-

Prem Mandir – 8 km

-

ISKCON Temple – 8.3 km

Frequently Asked Questions

There are different types of home loans available depending upon the purpose for which the home loan is being taken.

In order to avoid any unpleasant surprises in future, the buyer should at the first place be aware of his financial credibility, eligibility and affordability. He should compare the interest rates offered depending on the type of loan, and should be aware of other things like refinancing option, flexible payments option, foreclosure charges if any and part payment facility.

In order to avoid any unpleasant surprises in future, the buyer should at the first place be aware of his financial credibility, eligibility and affordability. He should compare the interest rates offered depending on the type of loan, and should be aware of other things like refinancing option, flexible payments option, foreclosure charges if any and part payment facility.

For taking a home loan, the applicant should be either an NRI or an Indian resident, should be of minimum 24 years of age at the time of loan commencement and below 60 years at the time of loan maturity and should have a steady income source.

The extra costs usually accompanying a home loan are the Processing Charges, Pre-Payment Charges and Miscellaneous Costs like some sort of documentation or consultation charges.

Interest paid up to a maximum of Rs 1, 50,000/- will be eligible for deduction from gross income on loan after completion of construction and will be deductible from income from property.

Contact Us

Suncity Anantam RERA No.

UPRERAPRJ541853 (SEC.-2)

UPRERAPRJ734 (SEC.-3)